Client

JaeVee is a prop-tech business based in Norwich, UK. They are the UK’s first facilitator, asset & project manager between property developers, investors and senior debt lenders. Their equity crowdfunding platform provides investors with opportunities in the UK property market from the comfort of their own home.

Implementing an equity crowdfunding platform

I began working on a new equity crowdfunding platform for JaeVee in February 2018. Due to heavy regulation in this area, I had many things to consider.

Onboarding

As part of the onboarding process, I had to create Anti-Money Laundering (AML) & Know Your Client (KYC) checks for individuals and businesses signing up to JaeVee’s platform.

Clients were also required to self certify and complete an appropriateness test before being allowed to invest.

Managing funds

Equally important, I sourced and implemented a very effective e-wallet system from MangoPay.

In effect, this allowed the platform to add funds to e-wallets, transfer between e-wallets and transfer funds from an e-wallet to a bank account.

As a result, this met the compliance needs of the business to ensure it met the guidelines set by the Financial Conduct Authority (FCA).

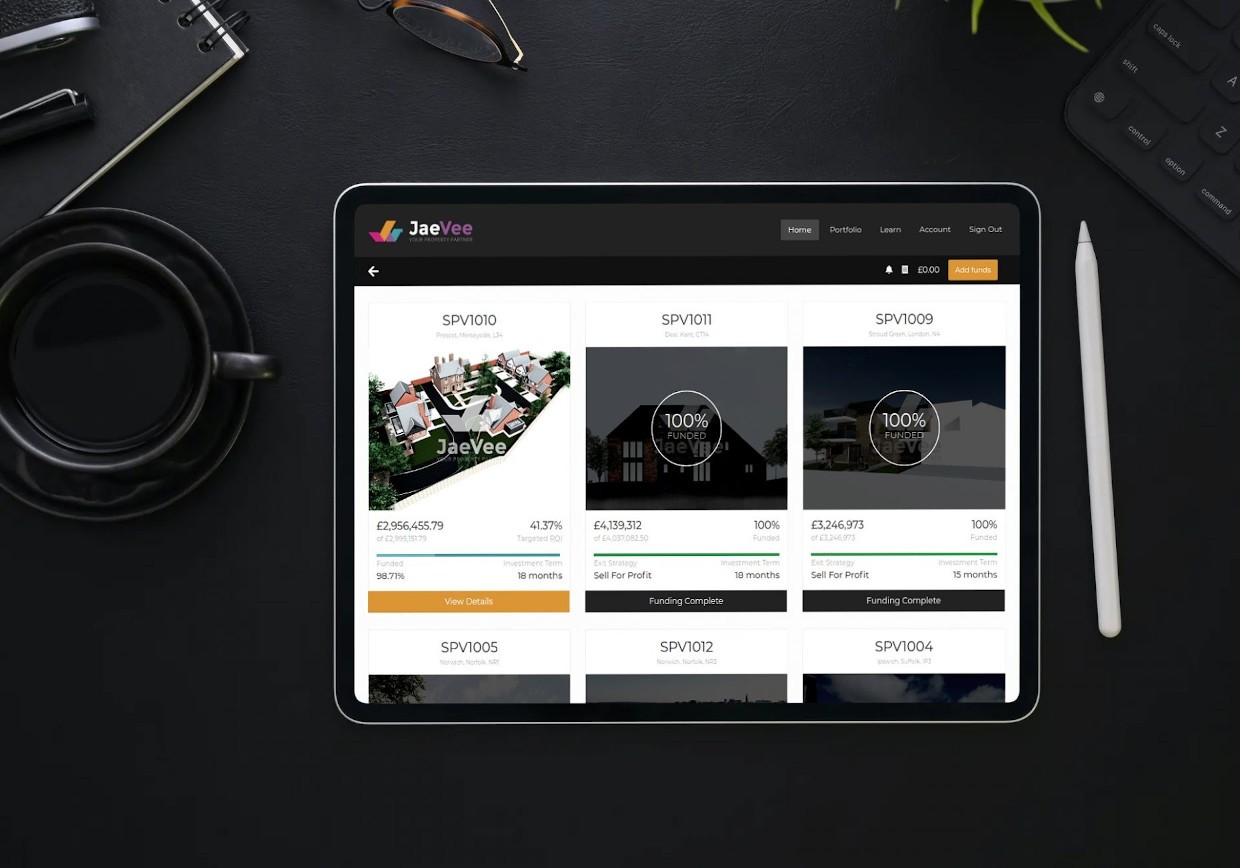

Projects

Projects came in two forms of return; capital and income. Calculations and the information for both were vastly different.

As a result, I designed investment views to accommodate documentation, financials, an investment calculator, proposed images, floor plans and detail about the investment strategy, property summary, exit strategy, operational delivery and development team.

To make investing more simple, the shareholder and development agreements could be generated and downloaded for each project prior to investing.

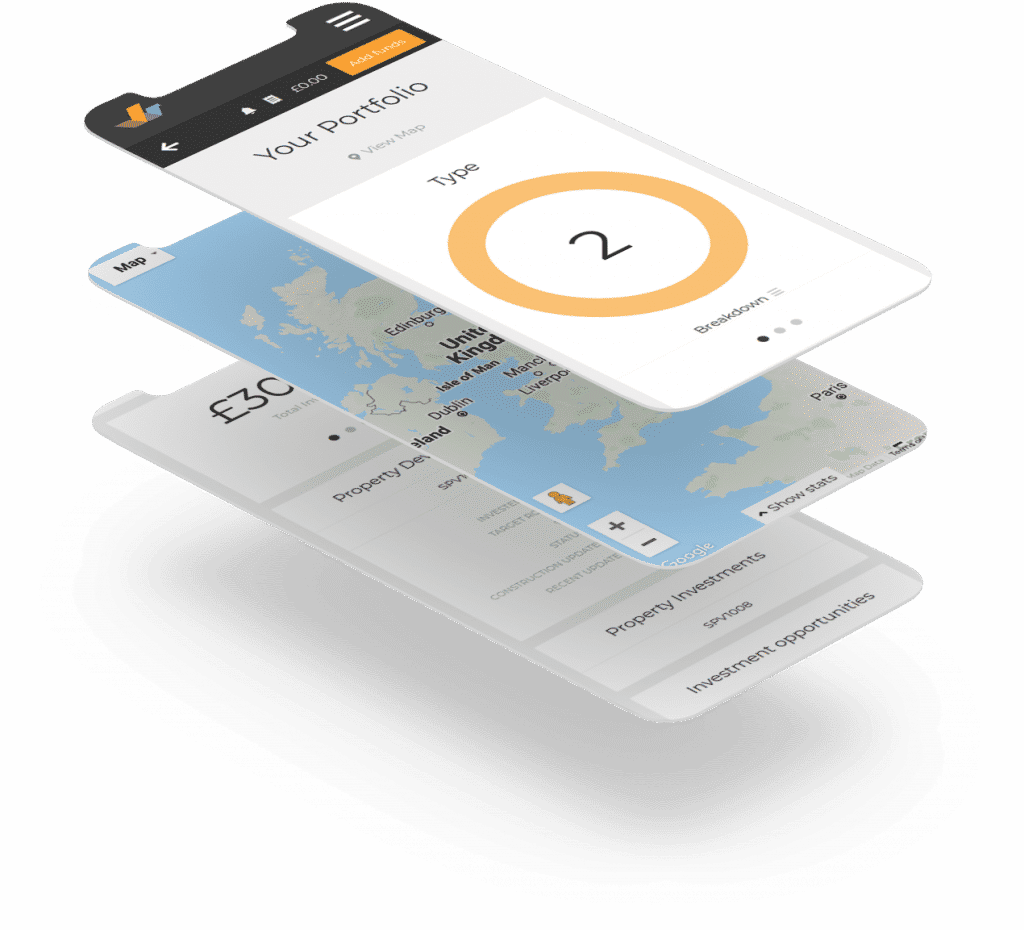

Portfolio

In addition, to showcase an investor’s investments and their performance, I created an investment portfolio. To clarify, this provided an overview of the types of investments (Residential/Commercial), strategies (Capital/Income) and locations of the projects they had invested in.

The investor could also see how much they invested, the target return on their investment and all the updates on the project.

Regulating an equity crowdfunding platform

Above all, JaeVee needed an audit trail for every operation that occurred throughout the platform to ensure it remained compliant.

To improve this further, we provided a back office management system, so JaeVee could monitor and produce any details required by the Financial Conduct Authority (FCA) during their quarterly and annual reviews.

In addition, this included a reporting facility for any information that needed to be exported.

Since its launch in May 2018, JaeVee’s equity crowdfunding platform has raised over £20M.

Tasks included

- Database administration

- Web design & build

- Onboarding process

- e-Wallet system integration

- AML & KYC management

- Back office management

- Document uploads/validation

- Auditing/reporting facility

- Compliance reviews